MVNO Business Model: Balancing Telecom Revenues with Cross-selling Core Services

- April 4, 2024

- Posted by: Allan Rasmussen

- Category: Insights

Generate telecoms revenues or cross-sell core business

Launching a mobile virtual network operator (MVNO) has traditionally had one of two main objectives – Generate telecoms revenues or cross sell core business.

The more traditional objective, has been to generate revenue from telecoms services, with MVNOs launching purely to capture a share of the voice, data, SMS market.

Many of the early MVNOs focused on providing services similar to the traditional mobile operators albeit at lower prices. However the focus trend today is more towards offering bundle service, and targeting specific niche segments.

Generate Telecoms Revenues

Below are examples of MVNOs operating their businesses mainly on generating revenue from selling telecoms services (voice, data, SMS), and other telecom related services or products.

Table 1: Generate Telecoms Revenues – E.g. MVNO Lebara, MVNO Penguin, MVNO Circles Life

| GENERATING TELECOMS REVENUES | ||

|  |  |

| MVNO Lebara (International) | MVNO Penguin (Thailand) | MVNO Circles Life (Singapore) |

| Business model: Niche (Ethnic) MVNO. Segments: Expat / Ethnic Proposition: Cheap international calls. | Business model: Discount MVNO. Segments: Rural Thais, border workers. Proposition: Cheap day-to-day packages. | Business model: Niche MVNO. Segments: Youth, tech-savvy data users. Proposition: Customize your own plans. |

Up-sell / Cross-sell Core Business

The second, and increasingly more common objective, is using MVNO as channel to up sell or cross-sell from the company’s existing core business, often seen as the choice for brands, having an existing user base and/or distribution channels.

In Table 2 below, are three examples of companies operating as MVNOs with a focus on up-selling, or cross-selling services or products from its existing business, while still maintaining a fair business on telecom services.

Table 2: Up-sell / Cross sell core business – E.g. MVNO Tune Talk, MVNO Snail Mobile, MVNO Woolworths.

| UP-SELL / CROSS-SELL CORE BUSINESS | ||

|  |  |

| MVNO Tune Talk (Malaysia) | MVNO Snail Mobile (China) | MVNO Woolworths (Australia) |

| Business model: Niche MVNO. Segments: Students, Travelers Objective: Cross-sell tickets to no frills airline AirAsia, and insurances. | Business model: Media MVNO. Segments: Gamers, Youth Objective: Up-sell games and gaming from the Snail game portfolio. | Business model: Retail MVNO. Segments: Families, parents, shoppers. Objective: Up-sell FMCG from the Woolworths supermarket chain. |

Some MVNOs have started out with one objective, and then moved to the other, or kept a foot in each.

In example, the Chinese MVNO Snail Mobile, is a prime example of adapting to opportunities. The wholesale market in China does not provide enough margin to launch a MVNO purely on generating telecoms revenue, as the wholesale rates from the MNO’s is the same as the retail price.

As a result, Snail Mobile chose to uplift its parent company Suzhou Snail Digital Technology, better known as Snail Games – a global provider of online games. At the end of 2017, Snail Mobile announced it had achieved 11 million subscribers.

However with the increasing amount of Chinese tourist visiting the APAC region (8.73 million Chinese tourists visited Thailand in the first nine month of 2018) Snail Mobile also moved into generating telecoms revenue by selling local Thai SIMs to the Chinese tourists visiting Thailand.

You can say that the some of the successful ethnic MVNOs, also have moved into a combination of the above objectives. While still making revenue on voice/data, MVNOs like Lycamobile, Vectone and Lebara are no longer just selling telecom service but cross selling money transfer service, insurance and entertainment with content from the subscribers home country.

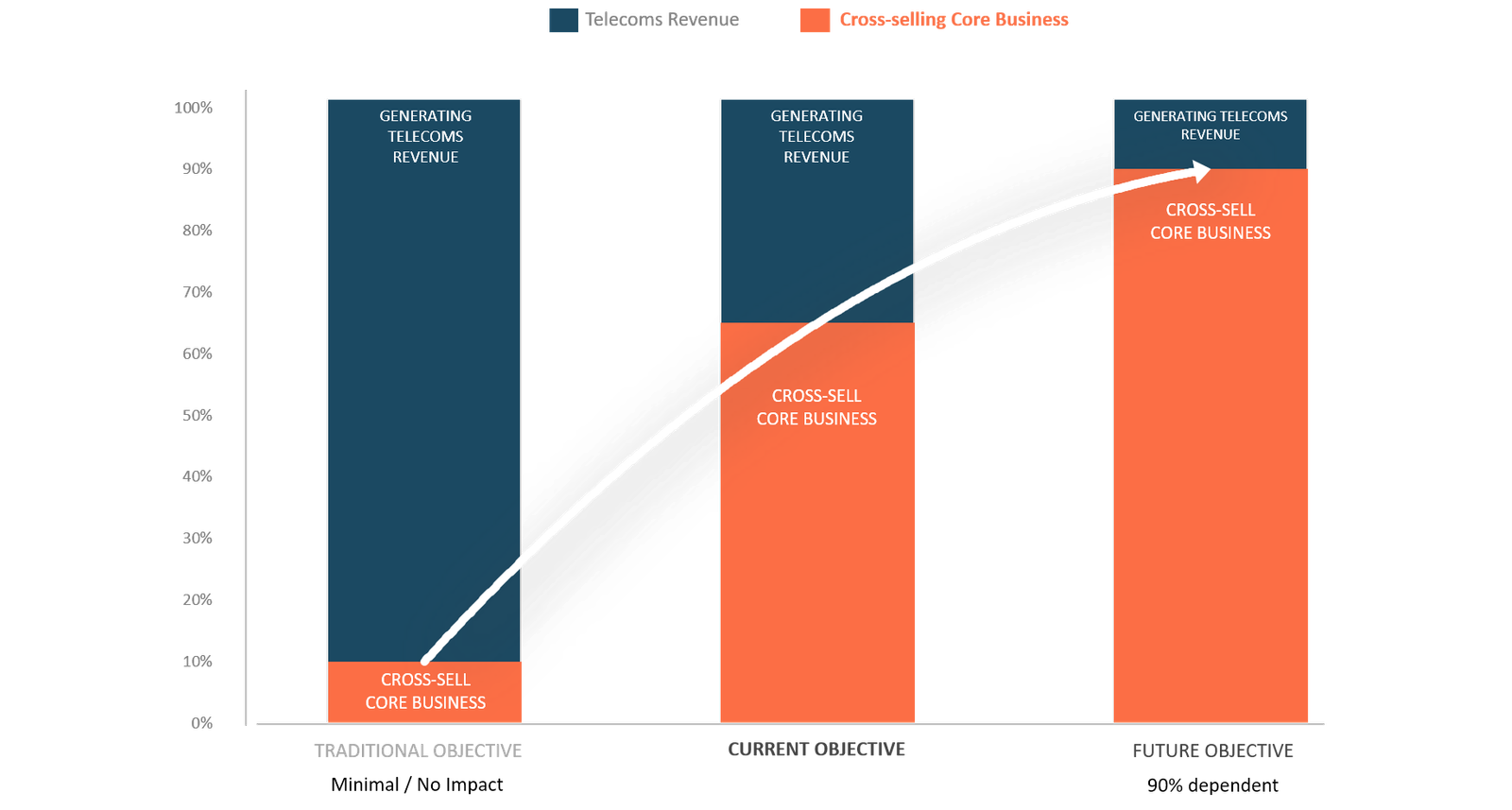

The Cross-sell Core Business Revenue Model Continues to Increase in Popularity

There are a couple of reason why cross-selling cores business is increasing and telecoms revenue stream is decreasing.

In markets where connectivity has reached saturation point and slowly becoming a commodity, the traditional mobile operators are fighting the only way they know how, and that is to lower the prices, or subsidizing handsets on contracts, creating a price war in the market and lower ARPU – making pure telecoms revenue streams less attractive.

As we move more into the digital transformation, we will continue to see more industry specific MVNOs targeting Internet of Things (IoT) and machine to machine (M2M). The increasing growth of IoT and M2M services, is also taking a toll on the telecoms revenue stream as many of these services aren’t necessarily heavy users of data. Instead new business models, which rely on cross-selling core business products or service are introduced.

Artificial Intelligence (AI) and Machine Learning (ML) with data analytics, provides the MVNOs with a holistic view of their customers lifestyle (their Needs, Wants, Nice to Haves) and thus an opportunity to supply this demand beyond telecom services.

Chart 1: Change in MVNO Revenue Stream from Telecoms Revenue to Cross-sell Core Business.

Giants entering the MVNO business

The up-sell/cross-sell objective, has also provided us with a new batch of MVNO entries recently, from giants in the likes of Google, Alibaba, Foxconn, Panasonic, Lenovo, Haier, Xiaomi, etc. who has entered the MVNO sphere, only using voice, and data as a transport, to provide their own services and products.

In example, when you buy a Panasonic freezer, microwave, or other device that needs Internet access, it comes loaded with a Panasonic SIM (e-SIM), and ready to use out-of-the-box, so the customer does not have to shop around with third parties to figure out which mobile operator to use for the SIM.

Similarly, should a problem arise the customer does not have to guess, if the problem is with the device, or related to connectivity (mobile operator) they just contact Panasonic.

Doing so, the customer journey, experience, and usage data stays with Panasonic, who can use this data to customize and optimize their products and offers, based directly on its customers usage.

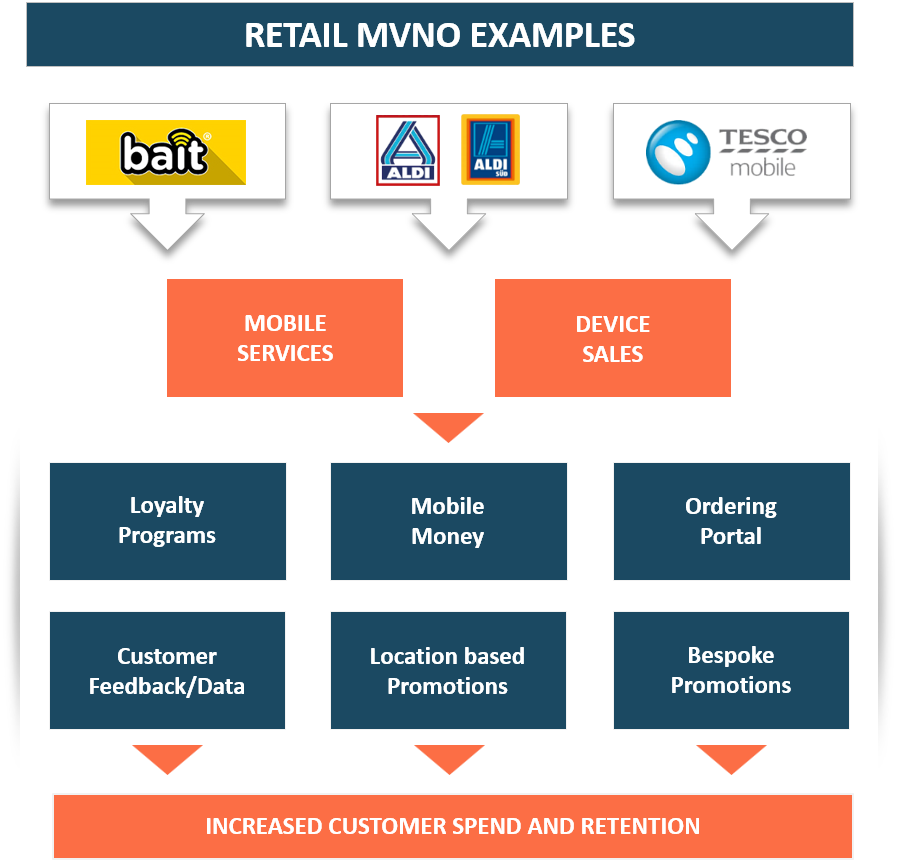

The MVNO Masters of Cross-selling Core business

The champions when it comes to cross selling core business, is however still the retail MVNOs, in the likes of Bait (Walmart Mexico), Tesco Mobile, Aldi Mobil, Woolworths Mobile, ASDA Mobile, etc.

Over the years they have managed to create a myriad of programs linked with their MVNO to cross-sell their main products and services.

The most popular program is the loyalty programs, where users get points when topping up their mobile account, which they can redeem into discounts when shopping

Or in reverse, getting points when purchasing over a certain amount in the shop, which the customer can then redeem as mobile credits on their mobile account.

Besides the programs shown in the Retail MVNO Cross selling Example, a cashback program, where users are getting credits on their mobile account instead of cash back- has also grown in popularity, and offers a win/win for all parties involved.

Common MVNO Business Models

Some of the more successful MVNOs have made use of their existing marketing assets, including their existing customer base, brand affinity and/or distribution channels. They have used these assets to create a unique brand positioning and value proposition in order to attract their MVNO target segment.

MVNOs are based on alternative business models, with identified market objectives: business model, value proposition, target segments and enabling environment, just as it is summarized in Table 1 below.

MVNOs can differentiate their offerings and take advantage of existing connectivity gaps in the market in their search for new niches in the market. I.e. Provide emerging IoT/M2M solutions, facilitate preferential access to services, games and OTT applications, or use mobile networks as transportation for financial services.

Table 3: Common MVNO Business Models.

| BUSINESS MODEL | VALUE PROPOSITION | TARGET SEGMENTS | ENABLING ENVIRONMENT | MVNO EXAMPLES |

| NICHE MVNO |

|

|

|

|

| RETAIL MVNO |

|

|

|

|

| DISCOUNT MVNO |

|

|

|

|

| ROAMING MVNO |

|

|

|

|

| B2B MVNO |

|

|

|

|

| TELCO MVNO |

|

|

|

|

| SUB-BRAND MVNO |

|

|

|

|

| MEDIA MVNO |

|

|

|

|

| M2M/IoT MVNO |

|

|

|

|

| DATA (OTT) MVNO |

|

|

|

|

Latest Post

25 Years of MVNO: Revolutionizing the Telecom Industry

Celebrating 25 years of MVNOs: How they revolutionized the telecom industry, empowered consumers and shaped the mobile connectivity

December 3, 2024How MVNOs Drive Value and Improve Lives: Insights from ITU

ITU: How MVNOs drive value, improve lives, and contribute to digital transformation by offering innovative services and solutions.

November 9, 2024MVNO Strategy: How Market Differentiation and Segmentation Drive Success

Mobile Virtual Network Operators (MVNO) have achieved a competitive edge by capitalizing on market differentiation and segmentation rather than merely competing on connectivity and price.

November 9, 2024