Vietnam’s Telecom Market: Key Statistics and Insights for 2023

- February 17, 2024

- Posted by: Allan Rasmussen

- Category: Insights

There are currently four licensed MVNOs in Vietnam but more are expected to join soon

0

(estimated)

0

EoY 2023

0

EoY 2023

0

EoY 2023

0

EoY 2023

0

As of June 2023

0

About $3.4

0

As of June 2023

EoY 2023, Vietnam had 124,1M mobile connections

0

(24.17%)

0

(3%)

0

(70.75%)

0

(4.83%)

Number of active mobile phone subscribers using Voice and SMS in Vietnam:

0

(27.88%)

0

(1.45%)

0

(29.33%)

Number of active mobile phone subscribers using Data in Vietnam:

0

(62.26%)

0

(8.38%)

0

(70.6%)

Mobile data usage Vietnam:

0

MVNOs in Vietnam

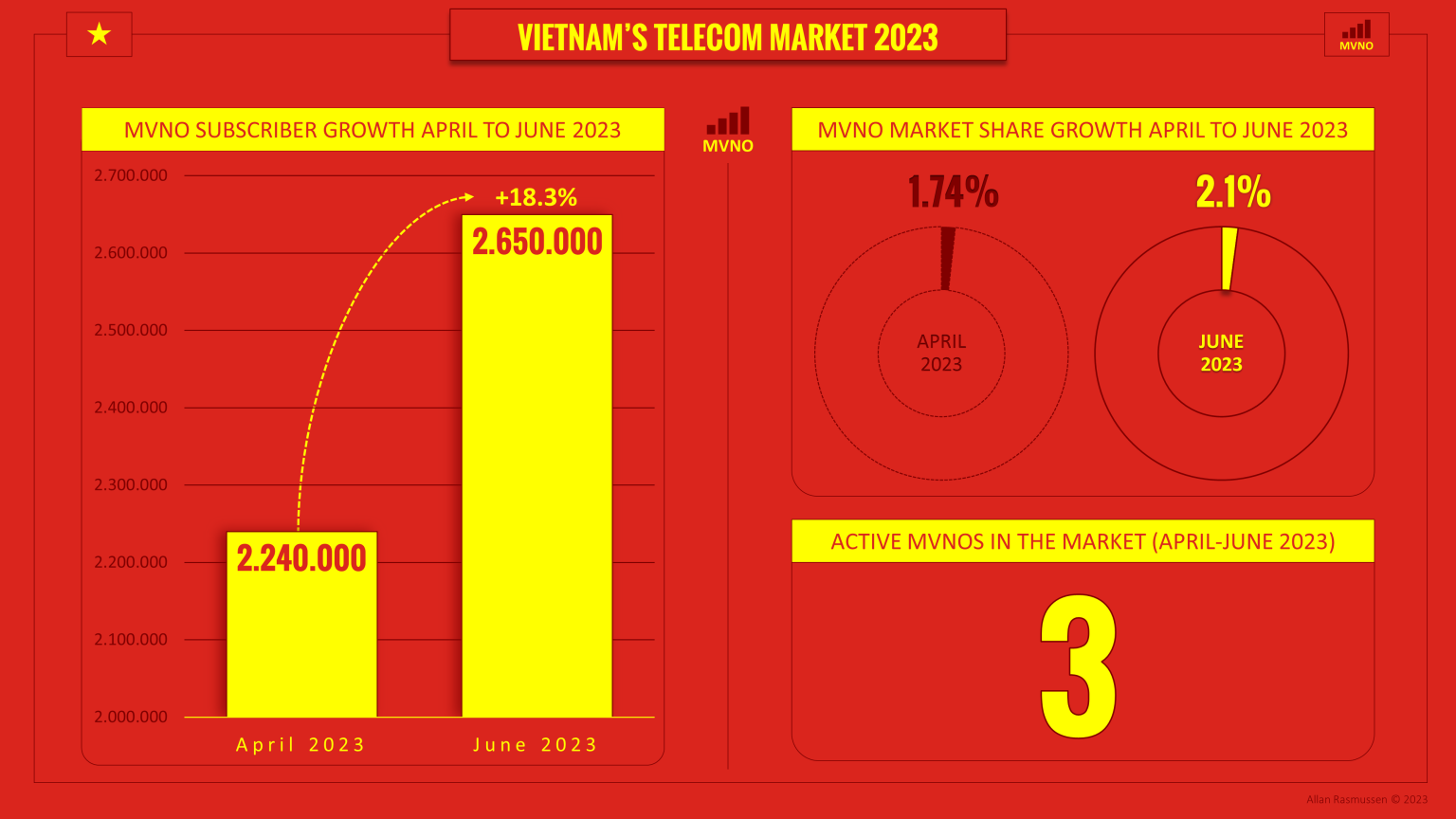

According to the Department of Telecommunications under the Ministry of Information and Communications (MIC), the number of active subscribers connected to Vietnam’s three (now five) mobile virtual network operators (MVNO), in June 2023 was 2.65 million, accounting for 2.1% of the total number of subscribers in the country.

The numbers represent an increase of 410,000 subscribers (+18.30%) in just two months, since the end of April 2023 release from MIC where the subscribers stood at 2.24 million, accounting for 1.74% of the total market.

On average, about 1.5 million new SIM subscriptions are sold in the market on a monthly basis. Of these, the three traditional operators; Viettel, VNPT, and MobiFone account for about 85% (1.275.000) of the new subscribers with the remaining 15% (225.000) going to Vietnam mobile and the MVNOs.

At the end of 2023, the Ministry of Information and Communications had licensed five MVNOs in Vietnam:

Vietnamese MVNO Subscriber growth April – June 2023

MVNO Itel (Indochina Telecom)

In April 2019, Indochina Telecom Joint Stock Company, operating the brand name Itel, became the first MVNO to launch in Vietnam, Itel launched its service using the network of Vinaphone – a subsidiary state-owned Vietnam Posts and Telecommunications Group (VNPT).

Itel initial service packages was designed to fit the segments of low income earners, students and factory workers.

After the launch of Itel, Nguyen Phong Nha, Deputy General Director of the MIC’s Authority of Telecommunications said. “The MVNO model will help save investment costs for businesses and avoid waste of resources as unused traffic and infrastructure of MNOs can be utilized by MVNOs that do not have their own infrastructure.”

MVNO Wintel (formerly Reddi)

Founded in 2016, Mobicast JSC obtained its license to operate as a mobile virtual network operator (MVNO) under the brand Reddi in 2019, and in 2021 Masan Group Corporation – one of the three largest private sector companies in Vietnam (in terms of market capitalization), acquired 70% of Mobicast JSC, for a total cash payment of VND295.5 billion ($13 million).

With Masan Group’s acquisition, the MVNO was rebranded from Reddi to Wintel.

Prior to acquiring Mobicast, Masan had completed its retail and food and beverage service product portfolio (3F, MCH, MEATDeli, WinEco, Phuc Long), and established a presence in the financial lifestyle segment with Techcombank, merged with WinCommerce (Vingroup), to own the largest retail and consumer goods platform in Vietnam, and completed a strategic partnership with Alibaba to promote online consumption channels.

The entry into the MVNO business provided the foundation to digitalize Masan’s platforms and build a unified offline-to-online (O2O) products and services solution ecosystem.

By unifying its consumer base with the MVNO, Masan has the capability to create a sticky loyalty platform to deliver more value to its consumers and the mission is to develop efficient integrated O2O products and services platform to serve 50 million consumers throughout their daily journey by 2025.

In the first quarter of 2023, Wintel achieved 122,569 subscribers, and revenue of VND 16.48 billion ($656,000), up 457% over the same period in 2022.

At the time of acquiring Mobicast, Masan planned to expand its subscriber base, focusing on WinCommerce’s existing customer base. The MVNO is expecting to reach break-even in 2024/2025 when it reaches VND150 billion ($6M) in revenue and 1.4 million subscribers, equivalent to 16% of WinCommerce’s customer penetration rate.

MVNO Local by ASIM Telecom

In May 2021, the MVNO Local, developed by ASIM Telecom became the third MVNO in the market. Local provides 4G data SIM products from MobiFone.

Local’s 4G SIMs are covering all 63 provinces and cities with a maximum specified speed of 150/50 Mbps (download/upload).

Vu Minh Tri, CEO of ASIM Group, used to be CEO of Microsoft Vietnam

MVNO VNSKY

Digilife/VNPAY was awarded the license number 63/GP-CVT from the Ministry of Information and Communications (MIC) – to provide telecommunications services without its own network – from (license date): March 31, 2022. The license is valid until March 31, 2032.

VNPAY says it is introducing the MVNO VNSKY as a product that combines telecommunications and fintech with the mission to make “Digital life easy”.

Speaking at the launch event, Mr. Nguyen Van Dung – Director of VNSKY said: “We believe that VNSKY will become a universal passport for everyone to easily access digital utilities and telecommunications services. quality, thereby opening the infinite digital universe. Every call, every message, and every connection with VNSKY is a step closer to our goal of connecting 5,000,000 users by 2025 and becoming one of the 5 largest mobile operators in Vietnam.”

Founded in 2007, VNPAY is the forerunner of VNLIFE’s subsidiaries. is a financial technology (Fintech) and service company, providing electronic payment solutions in Vietnam. The company offers mobile banking, phone recharge, and bill payment solutions and services for more several Vietnamese banks, telecommunications companies, and e-commerce businesses.

VNPAY’s apps sees 15 million+ monthly active consumers transfer money, pay bills, top up mobile credits, book bus tickets, or shop for groceries, according to VNLife. The company also runs VNPay-QR, an interoperable cashless payment network that serves 22 million users and over 150,000 merchants.

In 2019, VNLife reportedly received $300 million from the SoftBank Vision Fund and Singapore state fund GIC, but did not disclose the information at the time. In July 2021, it raised more than US$250 million in a series B funding round co-led by US investors General Atlantic and Dragoneer Investment Group.

With these investments, VNLife secured its position as Vietnam’s second billion-dollar unicorn.

MVNO FPT SIM

FPT Retail-FRT has existing assets to leverage its MVNO on. Besides its brand value and existing customer base.

Firstly, as a distribution channel, FRT owns a nationwide retail network with over 800 FPT Shop stores and more than 1,000 FPT Long Chau pharmaceutical stores.

Secondly, is has technical and technological advantages, as FPT Retail can leverage on the strength of FPT Corporation, as one of the leading enterprise in Vietnam in the field of information technology.

Thirdly, FRT has the advantage of exploiting FPT’s diverse service ecosystem to develop bundle services such as fixed telecommunications services (FPT Telecom), content systems (telecom media). FPT Play (OTT model), VNExpress (electronic newspaper), e-commerce system (Sendo, fptshop.com.vn), and education (FPT Education).

MVNO Itel

(Indochina Telecom)

Energy, Real Estate and Retail

0

(estimated)

Launched: 04/2019

Host MNO: Vinaphone

MVNO Wintel

(Mobicast/Masan Group)

FMCG/Supermarket chain

0

As of Q1 2023

Launched: 04/2019

Host MNO: Vinaphone

MVNO myLocal

(ASIM Telecom)

“Super App”, OTT TV, Travel

0

(estimated)

Launched: 05/2021

Host MNO: MobiFone

MVNO VNSKY

(VNPAY)

Fintech, F&B, Travel, Bank App

0

(estimated)

Launched: 05/2023

Host MNO: MobiFone

The majority of the 2.65 million subscribers back in June were with the MVNO Itel, which was the first MVNO to launch in Vietnam in 2019, while the MVNO Wintel (formerly Reddi) announced 122,500 subscriptions in 1Q23.

The rest was with the MVNO myLocal (ASIM Telecom), as the MVNO VNSKY was launched on May 23, 2023, and thus not part of the June reporting.

Latest Post

Telco in 20 Podcast: The innovation inertia of MVNOs

MVNOs are often blocked by mobile network operators and regulatory hurdles. This podcast episode explores the real-world struggles of MVNOs.

September 17, 202525 Years of MVNO: Revolutionizing the Telecom Industry

Celebrating 25 years of MVNOs: How they revolutionized the telecom industry, empowered consumers and shaped the mobile connectivity

December 3, 2024How MVNOs Drive Value and Improve Lives: Insights from ITU

ITU: How MVNOs drive value, improve lives, and contribute to digital transformation by offering innovative services and solutions.

November 9, 2024