Thailand’s Mobile Service Market: Key Insights and Trends EoY 2023

- February 22, 2024

- Posted by: Allan Rasmussen

- Category: Insights

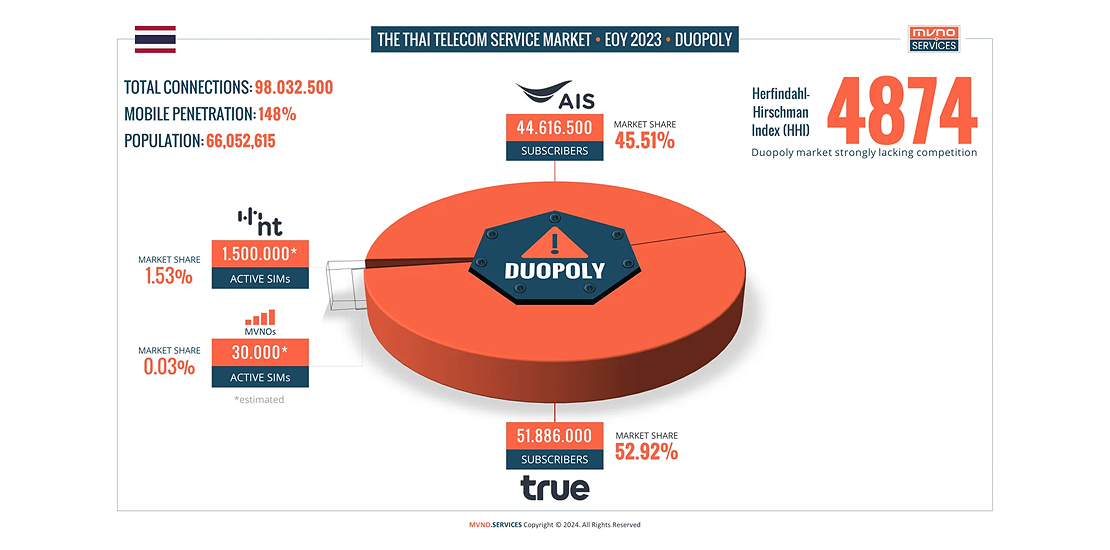

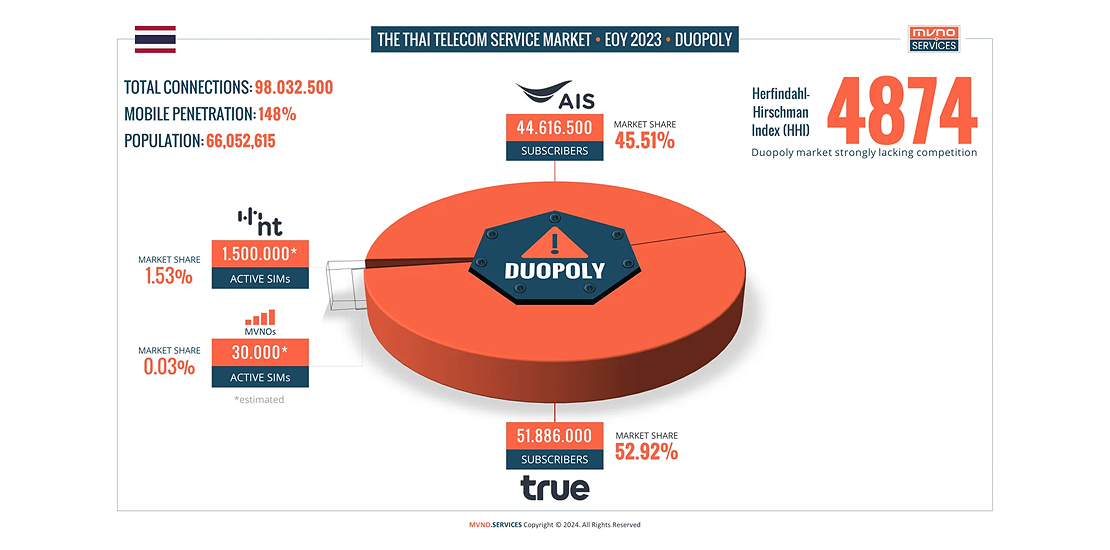

Thailand’s Mobile Market at the end of year 2023, shows a duopoly market in desperate need of competition.

2023 saw the merger of TRUE/DTAC increase its market share. Following the merger, the duopoly of AIS and TRUE introduced the same pricing/plans on 6 out of their 10 plans and decreased data allowance on several plans.

Total subscribers/connections between the duopoly of AIS and TRUE/DTAC was 96,502,500 out of 98.032.500 total mobile connections in the country at the end of 2023.

TRUE gained +512.000 compared to last quarter (QoQ) but lost -3.073.000 compared to the same period last year (TRUE and DTAC combined)

AIS added +166.800 Quarter on Quarter (QoQ) but lost -1.396.600 Year-on-Year (YoY).

Total subscribers (AIS and TRUE): 96,502,500, representing a growth of +678,800 QoQ but -4,442,600 YoY.

Chart: Thailand’s Mobile Duopoly (TRUE and AIS) – Mobile Subscribers Q4 2022 – Q4 2023.

AIS

+166.800 QoQ

-1.396.600 YoY

TRUE

+512,000 QoQ

-3.073.000 YoY

Thailand’s Mobile Service Market 2023 = Duopoly

Total subscribers/connections in Thailand at the end of 2023 was 98.032.500.

The population decreased slightly to 66,052,615, giving a mobile penetration of 148%.

AIS’ market share of the total connections in the market dropped to 45.51% (from 46.65% in Q3), while TRUE increased its market share to 52.92% (from 52.77% in Q3).

The state enterprise telco, National Telecom (NT) was status quo on the approx 1.5 million connections, same with the four MVNOs at approximately 30.000.

The Herfindahl-Hirschman Index (HHI) is a common measure of market concentration and is used to determine market competitiveness. A market with an HHI of less than 1,500 is considered to be a competitive marketplace, an HHI of 1,500 to 2,500 to be a moderately concentrated marketplace, and an HHI of 2,500 or greater to be a highly concentrated marketplace.

The Herfindahl-Hirschman Index (HHI) in the Thai mobile market was 3.420 before the TRUE/DTAC merger – showing a highly concentrated market lacking competition. The HHI increased in 2023 to 4.874 showing a duopoly market in desperate need of competition.

Image: Thailand’s Mobile Duopoly Market End Of Year 2023.

Thailand's Mobile Service Market Key Statistics EoY 2023

0

As of 2023

0

EoY 2023

0

EoY 2023

0

Lacks competition

0

in operation

0

($5.90)

0

EoY 2023

0

per subscriber/month

The Duopoly: AIS vs. TRUE/DTAC

The big two mobile operators in Thailand (AIS and TRUE/DTAC) at the end of year 2023:

AIS

(Advanced Info Service)

Mobile Subscribers

44.6M

Postpaid Subscribers

12.71M

Prepaid Subscribers

31.90M

Blended ARPU

THB 223,-

MVNO Partners

None

Total Spectrum

1,420 MHz

(*1,460 MHz)

Mobile Revenue

THB 118.13 billion

Total Assets

THB 454.43 billion

Total Liabilities

THB 363.76 billion

Total Revenue

THB 188.87 billion

Net Profit

THB 29.08 billion

TRUE

(TRUE/DTAC)

Mobile Subscribers

51.8M

Postpaid Subscribers

15.57M

Prepaid Subscribers

36.31M

Blended ARPU

THB 204,-

MVNO Partners

None

Total Spectrum

1,260 MHz

(*1,350 MHz)

Mobile Revenue

THB 125.89 billion

Total Assets

THB 744.72 billion

Total Liabilities

THB 658.58 billion

Total Revenue

THB 202.85 billion

Net Profit (Loss)

THB -15.68 billion

*Including network rental agreement with National Telecom

5G Package Subscriptions in Thailand End of Year 2023

At the end of 2023 there were 19,67 million 5G package subscriptions in Thailand.

TRUE claimed 10.5 of these while AIS claimed 9.17 million.

The 19,67 million represents a 5G share of 20% of total connections in the market. However, note that they brand all packages as 5G, and 5G package subscriptions are also sold to customers with 4G LTE handsets, thus using 4G despite the package branded as 5G.

0

0

5G was launched commercially in Thailand in October 2020.

Thailand Demographics EoY 2023

0

Of the total population

0

0

0

0

TRUE DTAC - Postpaid Pricing Pre-Merger vs. Post Merger

TRUE and DTAC removed two of the low-priced packages in the market after their merger.

They raised the prices on three of the packages:

- TRUE raised the price on its 1,399 baht package to 1,499 but also raised the voice call minutes from 450 to 650 minutes.

- DTAC raised the 349 baht package with 20GB data and 100 voice minutes to 399 baht.

- DTAC also raised the 1,099 baht package with “unlimited” data and 200 minutes voice call to 1,199 baht although they also increased the voice call minutes to 350 minutes.

In addition they decreased the data or voice call minutes on the following packages:

TRUE

- TRUE dropped the data from 80GB to only 40GB and voice minutes from 300 to 250 minutes on its 499 baht packages.

- On its 599 baht package they also dropped the data, from 100GB to 50GB and voice from 300 to 250 minutes.

- On its 699 baht package they dropped the data from 120GB to 60GB and on the 899 baht package they dropped the data from 160GB to 80GB but increased the voice call from 200 to 300 minutes.

- On the 1.499, 1,699, 1,999 and 2,199 packages they increased the voice call minutes.

DTAC

- DTAC decreased the voice minutes on its 499 and 599 packages from 300 minutes to 250 minutes.

- On the 699 and 899 packages they decreased the data from 80GB and 100GB to 60GB and 80GB but increased the voice calling minutes from 80 and 100 to 300 minutes.

- They increased the voice minutes on the high-end packages 1,199, 1,499, and 1,999 but decreased it on the 2,199 package from “unlimited” to 1,700 minutes.

Giving extra voice minutes is a no-brainer as the two companies are now merged and as such, it is no longer customers of two different operators calling each other but one network (On-Net).

One of the conditions for the merger was the reduction of the average price by 12% which was supposed to have taken place maximum 90 days from the merger (May 30, 2023) still hasn’t been integrated, along with other measures such as launch of MVNOs on the networks of TRUE/DTAC.

The national telecom regulator (NTBC) responded to consumers and consumers associations’ complaint about the change in pricing and service by saying such claims have to be based on facts and evidence – not “feelings” and these facts are very difficult to obtain and calculate – interestingly, the source for the pricing and package is from the very same telecom regulator (NBTC). Perhaps it is very difficult for them to navigate their own website.

AIS - TRUE/DTAC - Same postpaid pricing after the TRUE/DTAC merger

After the TRUE/DTAC merger the duopoly has “somehow” come up with the exact same pricing and packages (GB and minutes) on 6 out of their 10 packages.

AIS denies there is a collusion between them and TRUE/DTAC.

If not the result of a coordinated behavior between the AIS and TRUE/DTAC, then by deciding individually on the packages and pricing, which somehow magically caused a collective outcome.

Perhaps they are using the same fortune teller?

Latest Post

Telco in 20 Podcast: The innovation inertia of MVNOs

MVNOs are often blocked by mobile network operators and regulatory hurdles. This podcast episode explores the real-world struggles of MVNOs.

September 17, 202525 Years of MVNO: Revolutionizing the Telecom Industry

Celebrating 25 years of MVNOs: How they revolutionized the telecom industry, empowered consumers and shaped the mobile connectivity

December 3, 2024How MVNOs Drive Value and Improve Lives: Insights from ITU

ITU: How MVNOs drive value, improve lives, and contribute to digital transformation by offering innovative services and solutions.

November 9, 2024